Key Takeaways

- Contactors are the most silver-sensitive devices, with silver costs representing 25-55% of total material costs depending on current rating

- Silver prices surged 147% in 2025, reaching $72/oz from $29/oz, creating unprecedented cost pressure on electrical equipment manufacturers

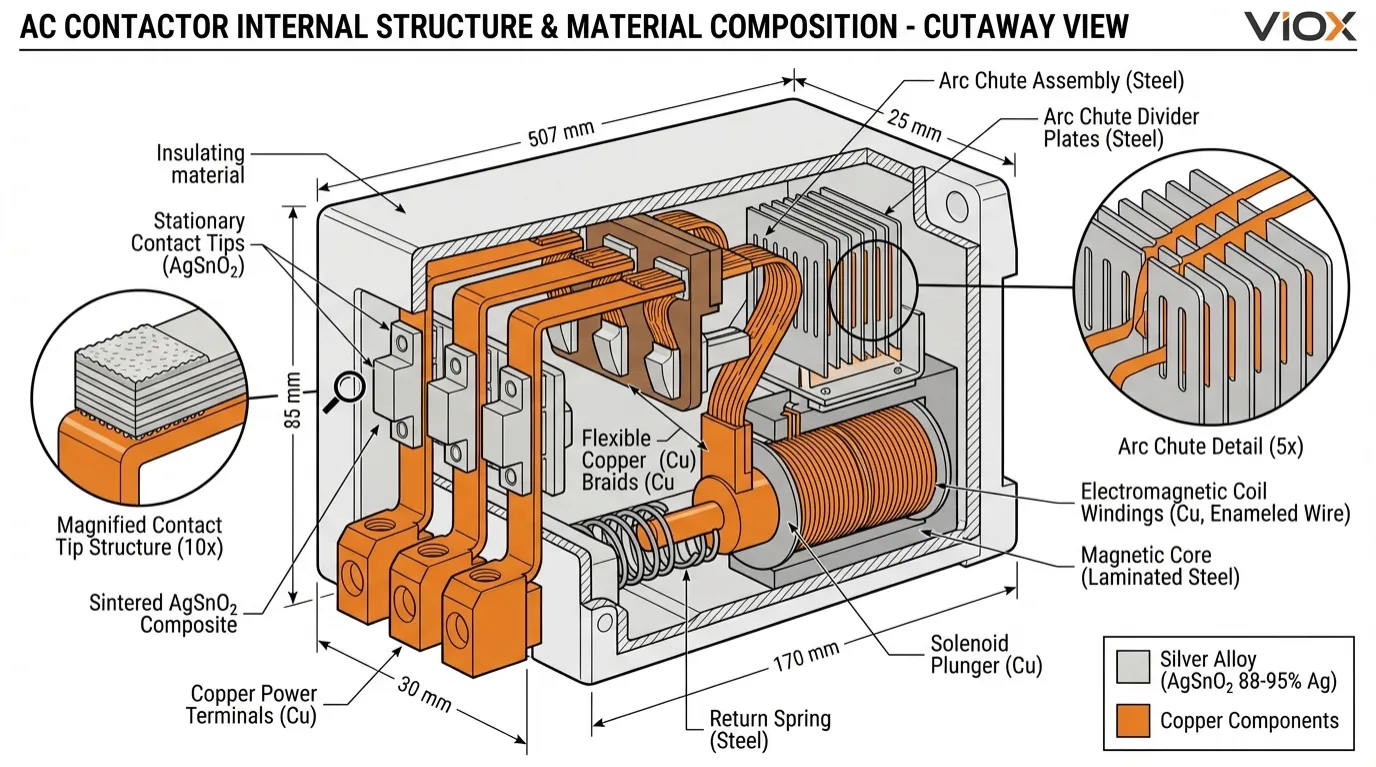

- AgSnO₂ (silver tin oxide) has replaced toxic AgCdO as the industry-standard contact material, containing 88-95% silver content

- Copper dominates distribution equipment costs, representing 45-62% of material costs in panelboards and switchgear

- Industrial demand for silver is structural, driven by solar panels, EVs, and AI infrastructure—not speculative trading

The 2025-2026 Silver Crisis: Why Electrical Equipment Costs Are Soaring

The electrical equipment industry entered 2026 facing an unprecedented materials crisis. Silver prices exploded from $29 per ounce in early 2025 to over $72 by year-end—a staggering 147% increase that caught even seasoned manufacturers off guard. This wasn’t a temporary spike; it represents a fundamental shift in silver’s role as a critical industrial metal.

Unlike previous commodity cycles driven by investment speculation, the current silver shortage stems from structural supply-demand imbalances. Global silver demand reached 1.17 billion ounces in 2024, outpacing mine supply by 500 million ounces—marking the fifth consecutive year of deficit. Industrial applications now consume over 59% of global silver production, with electrical and electronics sectors leading demand growth.

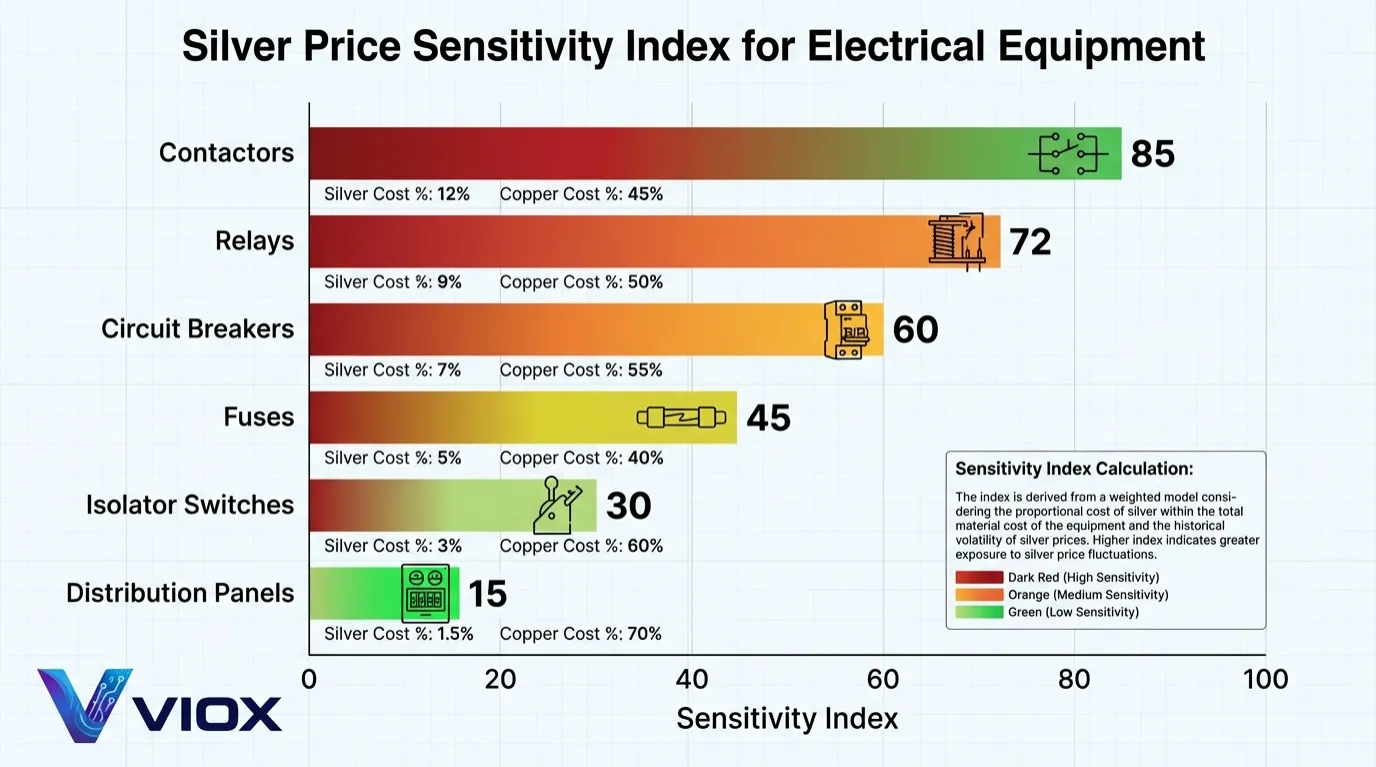

For B2B electrical equipment buyers, understanding which products are most vulnerable to silver price volatility has become essential for procurement strategy and budget planning. This comprehensive analysis ranks contactors, circuit breakers, relays, fuses, isolator switches, and distribution panels by their sensitivity to both silver and copper price fluctuations.

Understanding Silver and Copper in Electrical Contacts

Why Silver Dominates Electrical Contacts

Silver possesses the highest electrical conductivity of any metal at 100% IACS (International Annealed Copper Standard), surpassing even copper’s 97% rating. This superior conductivity translates directly into lower contact resistance, reduced heat generation, and improved reliability in switching applications.

But conductivity alone doesn’t explain silver’s dominance. Silver’s unique combination of properties makes it irreplaceable in high-reliability switching:

- Arc erosion resistance: Silver withstands the extreme temperatures (3,000-20,000°C) generated during arc formation

- Anti-welding properties: Prevents contact fusion under high inrush currents

- Oxidation resistance: Silver oxide (Ag₂O) remains conductive, unlike copper oxide

- Thermal conductivity: Rapidly dissipates heat away from contact points

The Evolution to Silver Alloy Contacts

Pure silver, despite its excellent conductivity, lacks the mechanical strength and arc resistance required for modern switching applications. The industry has developed sophisticated silver alloy systems optimized for specific operating conditions:

| Alloy Type | Silver Content | Key Additives | Primary Applications | Key Properties |

|---|---|---|---|---|

| AgSnO₂ | 88-95% | Tin Oxide (5-12%) | Contactors, MCCBs, power relays | Excellent arc erosion resistance, environmentally friendly, replaced AgCdO |

| AgNi | 85-95% | Nickel (5-15%) | Relays, auxiliary switches, small contactors | High wear resistance, good anti-welding properties |

| AgW / AgWC | 50-75% | Tungsten / Tungsten Carbide | High-power circuit breakers | Extreme hardness, superior arc quenching |

| AgCu | 90-97% | Copper (3-10%) | Low-current switches, connectors | Cost-effective, good mechanical strength |

| AgSnO₂In₂O₃ | ~90% | SnO₂ + In₂O₃ (3-5%) | Automotive relays, precision switching | Enhanced anti-material transfer properties |

The transition from silver cadmium oxide (AgCdO) to silver tin oxide (AgSnO₂) represents one of the industry’s most significant material shifts. While AgCdO offered excellent performance, environmental regulations (RoHS, REACH) mandated its phase-out due to cadmium toxicity. Modern AgSnO₂ contacts now match or exceed AgCdO performance while remaining environmentally compliant.

Copper’s Supporting Role

Copper serves as the electrical “backbone” of low-voltage equipment, handling current transmission through busbars, terminals, and conductor paths. With 97% IACS conductivity and significantly lower cost than silver, copper dominates high-volume, low-resistance applications where switching duty doesn’t occur.

Copper’s limitations become apparent under switching conditions. Copper oxide (CuO) forms an insulating layer that increases contact resistance over time. This makes pure copper unsuitable for contact surfaces, though it remains ideal for fixed current-carrying components.

Silver Sensitivity Ranking: Which Equipment Is Most Vulnerable?

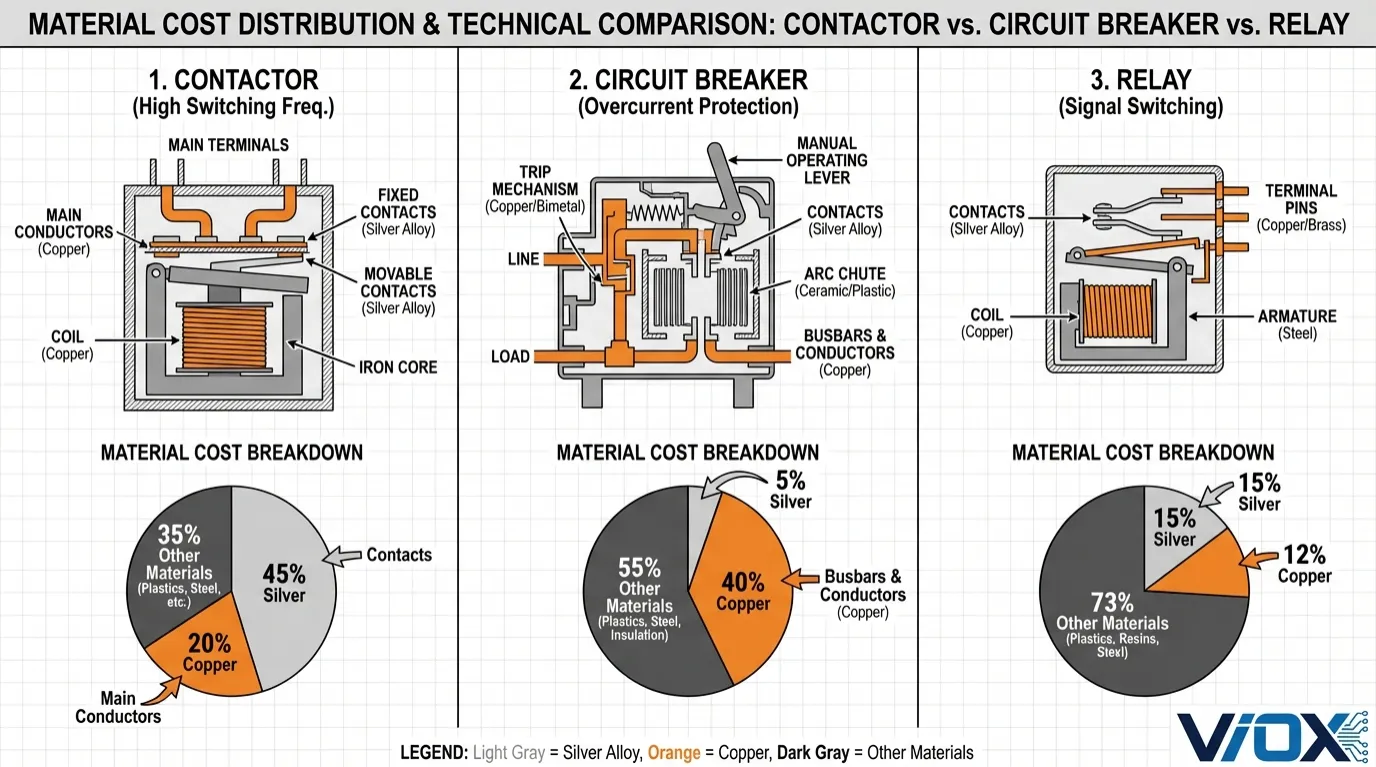

1. Contactors: The Silver-Intensive Champion (Highest Sensitivity)

Silver Cost Impact: 25-55% of total material costs

Contactors represent the most silver-dependent category in low-voltage electrical equipment. These workhorses of industrial control systems must endure millions of switching cycles under demanding conditions—making silver contacts absolutely essential.

Why Contactors Consume So Much Silver

Unlike circuit breakers that primarily handle fault conditions, contactors perform frequent load switching with high inrush currents. A typical motor starter contactor experiences:

- Starting inrush currents: 6-8× rated current for 0.1-0.5 seconds

- Electrical life: 200,000 to 2,000,000+ operations depending on load type

- Arc energy: Repeated arc formation during every switching cycle

These severe operating conditions demand thick, high-quality silver alloy contacts. The contact thickness directly determines electrical life—each arc erodes a microscopic layer of material.

Silver Usage by Contactor Size

| Contactor Rating | Typical Silver Content | Silver Cost as % of Materials | Contact Alloy | Electrical Life (AC-3) |

|---|---|---|---|---|

| 9-25A (NEMA 00-0) | 2-5 grams | 25-35% | AgSnO₂ (90-95% Ag) | 2,000,000 ops |

| 32-63A (NEMA 1-2) | 8-15 grams | 35-40% | AgSnO₂ (88-92% Ag) | 1,000,000 ops |

| 80-150A (NEMA 3-4) | 20-40 grams | 40-45% | AgSnO₂ (88-90% Ag) | 500,000 ops |

| 185-400A (NEMA 5-6) | 60-120 grams | 45-55% | AgSnO₂ + AgW arcing tips | 200,000 ops |

Cost Impact of 147% Silver Price Increase

For a 200A contactor with 50 grams of AgSnO₂ (92% silver content):

- Silver content: 46 grams pure silver (1.48 troy ounces)

- Silver cost at $29/oz (Jan 2025): $42.92

- Silver cost at $72/oz (Dec 2025): $106.56

- Cost increase per unit: $63.64 (+148%)

For a manufacturer producing 100,000 contactors annually, this represents an additional $6.36 million in material costs—before considering copper price increases.

Copper in Contactors

Copper accounts for 15-25% of material costs in contactors:

- Electromagnetic coil: Enameled copper wire (typically 0.5-2.0mm diameter)

- Power terminals: Brass or copper alloy

- Current-carrying bars: Copper or silver-plated copper

While significant, copper’s cost impact remains secondary to silver in contactor economics.

2. Relays: Small Size, High Silver Concentration (High Sensitivity)

Silver Cost Impact: 8-20% of total material costs

Relays use minimal silver by absolute weight—often just milligrams per unit—but their high silver concentration and massive production volumes make them significantly sensitive to silver price fluctuations.

Silver Usage Patterns in Relays

| Relay Type | Silver per Unit | Typical Alloy | Silver Cost % | Key Applications |

|---|---|---|---|---|

| PCB Power Relay (10-16A) | 20-50 mg | AgNi10-15 (90% Ag) | 8-12% | Industrial controls, HVAC |

| Automotive Relay (30-40A) | 50-100 mg | AgSnO₂In₂O₃ (90% Ag) | 12-18% | Vehicle electrical systems |

| Magnetic Latching Relay | 30-80 mg | AgSnO₂ (92% Ag) | 10-15% | Smart meters, battery systems |

| Signal Relay (<2A) | 5-15 mg | AgPd or fine Ag | 15-20% | Telecommunications, test equipment |

Why Automotive Relays Are Most Affected

Automotive relays face particularly challenging conditions:

- Capacitive loads: Power factor correction in LED lighting

- Inductive loads: Motors, solenoids, compressors

- Temperature extremes: -40°C to +125°C operating range

- Vibration resistance: Continuous mechanical stress

These requirements demand premium AgSnO₂In₂O₃ alloys with indium oxide additives (3-5%) to prevent material transfer between contacts. The indium addition further increases material costs beyond base silver prices.

Volume Amplification Effect

While individual relay silver content is small, production volumes amplify cost impact:

- A tier-1 automotive relay manufacturer producing 50 million units annually

- Average 60mg silver per relay = 3,000 kg total silver consumption

- At $29/oz: $2.83 million silver cost

- At $72/oz: $7.03 million silver cost

- Annual cost increase: $4.2 million

3. Circuit Breakers: Copper-Dominant with Strategic Silver Use (Medium Sensitivity)

Silver Cost Impact: 0.5-8% of total material costs

Circuit breakers prioritize copper for current-carrying capacity while using silver strategically at contact surfaces. This design philosophy makes them far less sensitive to silver prices than contactors.

Silver Usage by Circuit Breaker Type

| Breaker Type | Current Range | Silver Content | Contact Material | Silver Cost % |

|---|---|---|---|---|

| Miniature CB (MCB) | 6-63A | 0.1-0.5 g | AgSnO₂ or fine Ag | 0.5-2% |

| Molded Case CB (MCCB) | 63-630A | 2-15 g | AgW / AgWC (50-75% Ag) | 1.5-5% |

| MCCB (High Current) | 800-1600A | 15-40 g | AgW / AgWC | 3-8% |

| Air Circuit Breaker (ACB) | 630-6300A | 50-200 g | AgW main + AgC arcing | 2-6% |

Why Circuit Breakers Use Less Silver

Circuit breakers differ fundamentally from contactors in their operating philosophy:

- Infrequent operation: Designed for occasional fault interruption, not continuous switching

- Short-circuit duty: Optimized for high breaking capacity rather than electrical endurance

- Arc energy concentration: Extreme but brief arc exposure during fault clearing

These conditions favor silver-tungsten (AgW) and silver-tungsten carbide (AgWC) alloys with 50-75% silver content—significantly lower than the 88-95% silver in contactor materials.

Copper Dominance in Circuit Breakers

Copper represents 30-50% of MCCB material costs:

- Main current path: Thick copper bars (5-15mm cross-section)

- Terminals: Brass or copper alloy with high clamping force

- Flexible connections: Copper braids for moving contacts

For a 400A MCCB:

- Copper content: ~800-1200 grams

- Silver content: ~8-12 grams

- Copper cost impact >> Silver cost impact

4. Fuses: Copper-Centric with Minimal Silver (Low Sensitivity)

Silver Cost Impact: 2-8% of total material costs

Fuses represent the least silver-sensitive protective device category. Their operating principle—sacrificial melting of a fusible element—makes copper the dominant material.

Silver Usage in Fuses

| Fuse Type | Silver Usage | Silver Application | Silver Cost % |

|---|---|---|---|

| Standard Cartridge Fuse | None to trace | Tin-plated copper contacts | 0-1% |

| High-Speed Fuse | 0.5-2 g | Silver-plated copper end caps | 2-4% |

| Semiconductor Fuse | 1-5 g | AgCu alloy fusible element (10-30% Ag) | 5-8% |

| HRC Fuse (High Rupturing Capacity) | 0.2-1 g | Silver-plated contact surfaces | 1-3% |

Why Fuses Use Minimal Silver

The fusible element itself—the core functional component—is almost always pure copper or copper alloy:

- Melting point control: Copper’s 1,085°C melting point provides predictable time-current characteristics

- Cost effectiveness: Copper costs 1/200th of silver per gram

- Sacrificial design: Element is destroyed during operation, making expensive materials economically impractical

Silver appears only at contact surfaces where:

- Corrosion resistance is critical for shelf life

- Low contact resistance ensures accurate current sensing

- Connection reliability affects overall system performance

Copper Dominance

Copper represents 35-50% of fuse material costs:

- Fusible element: Pure copper wire, ribbon, or perforated strip

- End caps: Brass or copper alloy

- Terminal connections: Copper or tin-plated copper

5. Isolator Switches: Copper-Heavy, Silver-Light (Very Low Sensitivity)

Silver Cost Impact: 1-5% of total material costs

Isolator switches (disconnect switches) prioritize visible isolation and current-carrying capacity over switching performance. This design philosophy minimizes silver requirements.

Silver Usage in Isolators

| Isolator Type | Current Rating | Silver Content | Contact Treatment | Silver Cost % |

|---|---|---|---|---|

| Rotary Isolator | 16-63A | 0.5-2 g | Silver-plated copper | 1-3% |

| Load Break Switch | 63-400A | 2-8 g | AgCu composite (5-15% Ag) | 2-5% |

| Fused Disconnect | 30-200A | 1-4 g | Silver-plated contacts | 1-4% |

Why Isolators Use Minimal Silver

Isolators are designed for infrequent operation under no-load or minimal-load conditions:

- Switching frequency: Typically <100 operations per year

- Load breaking: Often prohibited or limited to minimal currents

- Contact pressure: High mechanical force reduces need for premium contact materials

Many isolators use silver plating (5-15 microns thick) over copper contacts rather than solid silver alloys. This provides adequate corrosion resistance and conductivity at minimal silver consumption.

Copper Dominance

Copper represents 40-60% of isolator material costs:

- Main contacts: Thick copper bars or blades

- Busbars: Solid copper construction (10-30mm cross-section)

- Terminals: Heavy-duty copper lugs

6. Distribution Panels and Switchgear: The Copper Kings (Minimal Silver Sensitivity)

Silver Cost Impact: <1% of total material costs

Distribution panels, load centers, and switchgear assemblies represent the least silver-sensitive category. Silver exists only within the protective devices (breakers, fuses) installed in the panel—not in the panel structure itself.

Material Distribution in Distribution Equipment

| Component | Primary Material | Typical Weight (400A Panel) | Cost % |

|---|---|---|---|

| Main Busbars | Copper (tin or silver-plated) | 15-30 kg | 45-55% |

| Branch Busbars | Copper | 5-10 kg | 10-15% |

| Neutral/Ground Bars | Copper | 3-8 kg | 5-10% |

| Enclosure | Steel or aluminum | 20-40 kg | 15-20% |

| Breakers (installed) | Mixed (contains silver) | 2-5 kg | 10-15% |

Copper Price Sensitivity

Distribution equipment manufacturers face extreme sensitivity to copper price fluctuations:

Example: 400A Main Lug Panel

- Total copper content: 25 kg

- Copper cost at $8,000/ton: $200

- Copper cost at $11,000/ton (+37.5%): $275

- Cost increase per panel: $75

For a manufacturer producing 50,000 panels annually:

- Annual cost increase: $3.75 million

This copper sensitivity far exceeds any silver-related cost pressure in distribution equipment.

Silver Content (Indirect)

Silver in distribution panels exists only within installed protective devices:

- 12-circuit residential panel with MCBs: ~2-3 grams total silver

- 42-circuit commercial panelboard: ~8-12 grams total silver

- Industrial switchgear with MCCBs: ~30-80 grams total silver

Comprehensive Sensitivity Ranking Table

| Equipment Type | Silver Sensitivity | Copper Sensitivity | Silver Cost % | Copper Cost % | Most Affected Current Ranges |

|---|---|---|---|---|---|

| Contactors | ★★★★★ (Extreme) | ★★★☆☆ (Medium) | 25-55% | 15-25% | 150A+ (NEMA 3-6) |

| Relays | ★★★★☆ (High) | ★★☆☆☆ (Low) | 8-20% | 10-18% | Automotive, power relays |

| Circuit Breakers | ★★★☆☆ (Medium) | ★★★★☆ (High) | 0.5-8% | 30-50% | 400A+ MCCBs, ACBs |

| Fuses | ★★☆☆☆ (Low) | ★★★★☆ (High) | 2-8% | 35-50% | Semiconductor fuses only |

| Isolator Switches | ★☆☆☆☆ (Very Low) | ★★★★★ (Very High) | 1-5% | 40-60% | All ratings |

| Distribution Panels | ☆☆☆☆☆ (Negligible) | ★★★★★ (Extreme) | <1% | 45-62% | All configurations |

Industrial Demand Drivers: Why This Isn’t a Temporary Spike

Understanding the structural nature of silver demand helps explain why electrical equipment costs will remain elevated:

Solar Photovoltaic Installations

Silver serves as the primary conductor in solar cell metallization. Each solar panel contains 10-15 grams of silver, and global installations continue accelerating:

- 2024: 500 GW installed capacity

- 2026 projection: 600+ GW installed capacity

- Silver demand: 230+ million ounces annually from solar alone

Solar demand alone now consumes 20% of global silver production.

Electric Vehicle Proliferation

Modern electric vehicles contain 25-50 grams of silver in sensors, contactors, battery management systems, and power electronics. Battery electric vehicles (BEVs) use 67-79% more silver than internal combustion engines.

- 2025: 12 million EVs produced globally

- 2031 projection: 35 million EVs annually

- Silver demand growth: 3.4% CAGR through 2031

AI and Data Center Infrastructure

The explosive growth in artificial intelligence workloads drives data center construction at unprecedented rates. High-efficiency electrical components, precision contacts, and thermal management systems all require silver.

Data center electricity consumption approaches 1,000 TWh annually by 2026—representing 3-5% of global electricity demand and creating sustained demand for silver-intensive electrical infrastructure.

Strategic Implications for Electrical Equipment Buyers

For Procurement Managers

- Prioritize long-term supplier relationships: Manufacturers with forward silver purchasing contracts can offer more stable pricing

- Consider product substitution: Where feasible, specify equipment with lower silver content (e.g., MCCBs instead of large contactors for motor protection)

- Evaluate total cost of ownership: Higher-quality silver contacts may justify premium prices through extended service life

- Request material cost transparency: Understanding silver vs. copper cost components enables better negotiation

For Design Engineers

- Right-size contactors: Oversized contactors waste expensive silver—select ratings based on actual load requirements

- Consider hybrid protection schemes: Combine MCCBs (copper-intensive) with smaller contactors (silver-intensive) for optimal cost

- Specify electrical life requirements: Longer electrical life demands thicker silver contacts—balance cost against replacement frequency

- Evaluate solid-state alternatives: For specific applications, solid-state contactors eliminate silver contacts entirely

For Maintenance Teams

- Implement contact inspection programs: Regular inspection extends silver contact life and prevents premature replacement

- Monitor contact resistance: Increasing resistance indicates wear—replace before failure

- Proper arc suppression: RC snubbers and varistors reduce arc erosion, extending silver contact life

- Avoid oversized loads: Operating contactors beyond ratings accelerates silver erosion

FAQ: Silver and Copper in Electrical Equipment

Why can’t manufacturers just use copper contacts instead of silver?

Copper oxide (CuO) forms an insulating layer on copper contacts, increasing resistance over time. Silver oxide (Ag₂O) remains conductive, maintaining low contact resistance throughout the product’s life. For switching applications with frequent operation, silver’s superior performance justifies its higher cost.

How much silver is actually in a typical contactor?

A 100A AC contactor contains approximately 15-25 grams of silver (0.5-0.8 troy ounces) in AgSnO₂ alloy form. At current silver prices (~$72/oz), this represents $36-58 in silver content per contactor.

Are there alternatives to silver in electrical contacts?

For low-current, low-voltage applications, gold-plated contacts offer excellent performance but at even higher cost. Graphite-based materials work for specific DC applications. However, for general-purpose AC switching in the 10-1000A range, no material matches silver alloys’ combination of conductivity, arc resistance, and reliability.

Why did silver prices increase so dramatically in 2025?

The increase stems from structural supply deficits (five consecutive years), explosive industrial demand (solar, EVs, AI infrastructure), and declining mine production. Unlike previous price spikes driven by investment speculation, the 2025-2026 increase reflects genuine physical shortages.

Will silver prices come back down?

Most analysts project silver prices will remain elevated through 2026-2027, with forecasts ranging from $65-75/oz. The structural demand from green energy transition and electronics manufacturing creates a long-term floor under prices. Significant price declines would require either major new mine discoveries or technological substitution—neither appears likely in the near term.

How can I verify the silver content in electrical equipment?

Reputable manufacturers provide material certifications and composition data. Silver content can be verified through X-ray fluorescence (XRF) analysis, which non-destructively measures alloy composition. For procurement verification, request material certificates of compliance (CoC) from suppliers.

Do used circuit breakers and contactors retain value due to silver content?

Yes, the secondary market for silver-bearing electrical components has grown significantly. Specialized recyclers purchase used contactors, breakers, and relays to recover silver content. However, functional used equipment typically commands higher prices than scrap value alone.

Conclusion: Navigating the New Materials Reality

The 147% silver price increase of 2025 represents more than a temporary cost shock—it signals a fundamental shift in electrical equipment economics. As industrial demand from solar, EVs, and AI infrastructure continues growing, silver’s role as a critical material will only intensify.

For electrical equipment buyers and specifiers, understanding the silver vs. copper sensitivity hierarchy provides essential strategic insight:

- Contactors face the most severe cost pressure and warrant careful specification and sourcing strategies

- Relays show high sensitivity despite small individual silver content due to massive production volumes

- Circuit breakers benefit from copper-dominant designs, with silver playing a supporting role

- Fuses and isolators show minimal silver sensitivity, with copper price fluctuations dominating cost structure

- Distribution equipment remains almost entirely insulated from silver prices, with copper representing the critical cost variable

The manufacturers who will thrive in this new environment are those who combine technical innovation (optimizing silver usage without compromising performance), strategic materials sourcing (forward contracts and supplier partnerships), and transparent customer communication about cost drivers.

At VIOX Electric, we’ve responded to these market dynamics by investing in advanced contact manufacturing technologies that maximize silver utilization efficiency while maintaining the reliability and performance our customers demand. Our engineering team continuously evaluates emerging contact materials and designs to deliver optimal value in this challenging materials environment.

Related Resources:

- Inside AC Contactor: Components & Design Logic

- Contactor Troubleshooting Guide: Buzzing & Coil Failure

- Industrial Contactor Maintenance & Inspection Checklist

- MCCB Busbar Connection & Protection Guide

- Circuit Breaker Ratings: ICU, ICS, ICW, ICM Explained

- Electrical Derating: Temperature, Altitude & Grouping Factors

About VIOX Electric

VIOX Electric is a leading B2B manufacturer of low-voltage electrical equipment, specializing in contactors, circuit breakers, relays, and distribution components. With over 30 years of industry experience, we combine advanced materials science with precision manufacturing to deliver reliable, cost-effective solutions for industrial, commercial, and infrastructure applications worldwide.