Βασικά συμπεράσματα

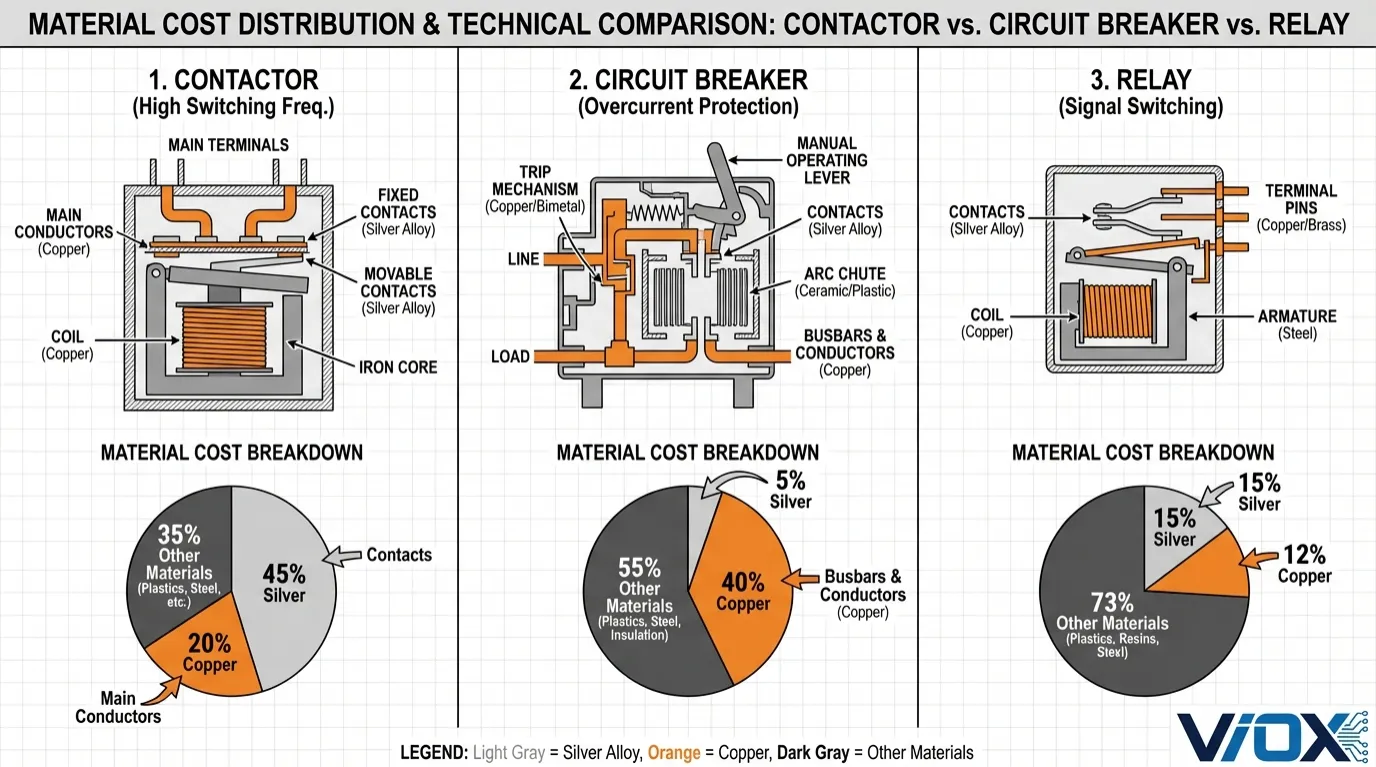

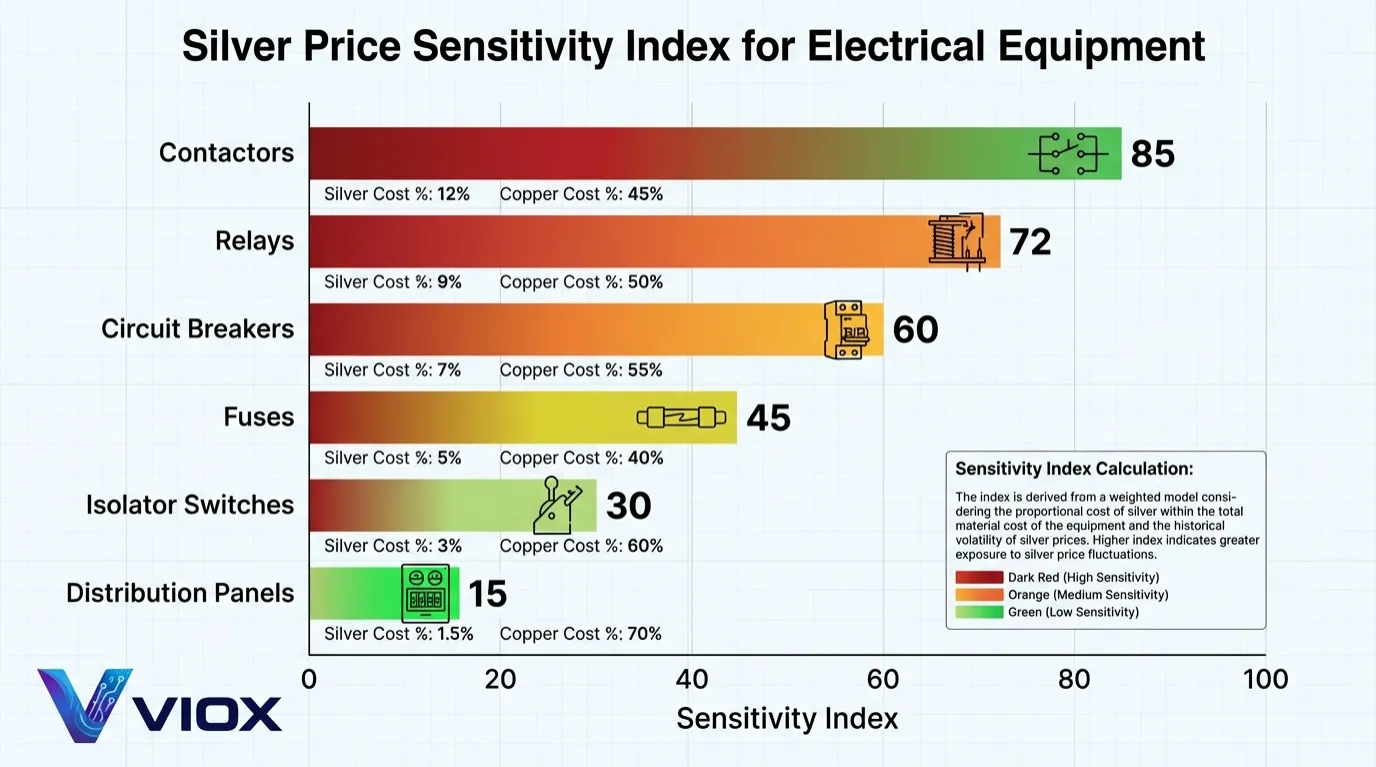

- Οι επαφείς είναι οι συσκευές με τη μεγαλύτερη ευαισθησία στον άργυρο, με το κόστος του αργύρου να αντιπροσωπεύει το 25-55% του συνολικού κόστους υλικών ανάλογα με την ονομαστική τιμή ρεύματος

- Οι τιμές του αργύρου αυξήθηκαν κατά 147% το 2025, φτάνοντας τα 72 $/ουγγιά από 29 $/ουγγιά, δημιουργώντας άνευ προηγουμένου πίεση κόστους στους κατασκευαστές ηλεκτρολογικού εξοπλισμού

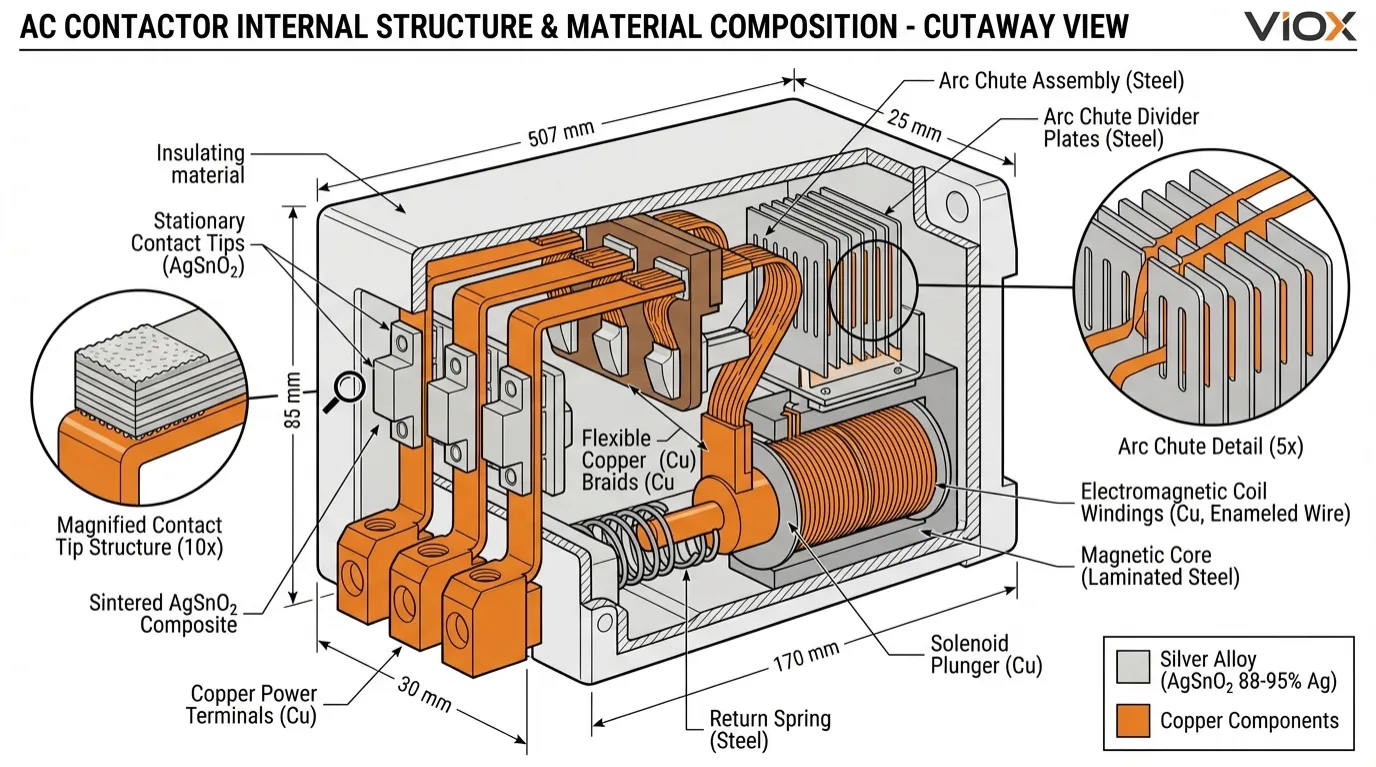

- Το AgSnO₂ (οξείδιο αργύρου-κασσιτέρου) έχει αντικαταστήσει το τοξικό AgCdO ως το βιομηχανικό πρότυπο υλικό επαφών, που περιέχει 88-95% περιεκτικότητα σε άργυρο

- Ο χαλκός κυριαρχεί στο κόστος του εξοπλισμού διανομής, αντιπροσωπεύοντας το 45-62% του κόστους υλικών σε πίνακες διανομής και πίνακες μεταγωγής

- Η βιομηχανική ζήτηση για άργυρο είναι διαρθρωτική, οδηγούμενη από ηλιακούς συλλέκτες, ηλεκτρικά οχήματα και υποδομές τεχνητής νοημοσύνης—όχι κερδοσκοπικές συναλλαγές

Η Κρίση Αργύρου 2025-2026: Γιατί το Κόστος του Ηλεκτρολογικού Εξοπλισμού Εκτινάσσεται

Η βιομηχανία ηλεκτρολογικού εξοπλισμού εισήλθε στο 2026 αντιμετωπίζοντας μια άνευ προηγουμένου κρίση υλικών. Οι τιμές του αργύρου εκτινάχθηκαν από 29 δολάρια ανά ουγγιά στις αρχές του 2025 σε πάνω από 72 δολάρια μέχρι το τέλος του έτους—μια εκπληκτική αύξηση 147% που αιφνιδίασε ακόμη και έμπειρους κατασκευαστές. Αυτή δεν ήταν μια προσωρινή αύξηση· αντιπροσωπεύει μια θεμελιώδη αλλαγή στον ρόλο του αργύρου ως κρίσιμου βιομηχανικού μετάλλου.

Σε αντίθεση με προηγούμενους κύκλους εμπορευμάτων που οδηγούνταν από επενδυτική κερδοσκοπία, η τρέχουσα έλλειψη αργύρου πηγάζει από διαρθρωτικές ανισορροπίες προσφοράς-ζήτησης. Η παγκόσμια ζήτηση αργύρου έφτασε τα 1,17 δισεκατομμύρια ουγγιές το 2024, ξεπερνώντας την προσφορά από τα ορυχεία κατά 500 εκατομμύρια ουγγιές—σηματοδοτώντας το πέμπτο συνεχόμενο έτος ελλείμματος. Οι βιομηχανικές εφαρμογές καταναλώνουν πλέον πάνω από το 59% της παγκόσμιας παραγωγής αργύρου, με τους τομείς ηλεκτρικών και ηλεκτρονικών ειδών να ηγούνται της αύξησης της ζήτησης.

Για τους αγοραστές ηλεκτρολογικού εξοπλισμού B2B, η κατανόηση του ποιες συσκευές είναι πιο ευάλωτες στην αστάθεια των τιμών του αργύρου έχει καταστεί απαραίτητη για τη στρατηγική προμηθειών και τον προγραμματισμό του προϋπολογισμού. Αυτή η ολοκληρωμένη ανάλυση κατατάσσει τους επαφείς, τους διακόπτες κυκλώματος, τα ρελέ, τις ασφάλειες, τους αποζεύκτες και τους πίνακες διανομής ανάλογα με την ευαισθησία τους στις διακυμάνσεις των τιμών τόσο του αργύρου όσο και του χαλκού.

Κατανόηση του Αργύρου και του Χαλκού στις Ηλεκτρικές Επαφές

Γιατί ο Άργυρος Κυριαρχεί στις Ηλεκτρικές Επαφές

Ο άργυρος διαθέτει την υψηλότερη ηλεκτρική αγωγιμότητα από οποιοδήποτε μέταλλο στο 100% IACS (Διεθνές Πρότυπο Ανόπτησης Χαλκού), ξεπερνώντας ακόμη και την βαθμολογία 97% του χαλκού. Αυτή η ανώτερη αγωγιμότητα μεταφράζεται άμεσα σε χαμηλότερη αντίσταση επαφής, μειωμένη παραγωγή θερμότητας και βελτιωμένη αξιοπιστία σε εφαρμογές μεταγωγής.

Αλλά η αγωγιμότητα από μόνη της δεν εξηγεί την κυριαρχία του αργύρου. Ο μοναδικός συνδυασμός ιδιοτήτων του αργύρου τον καθιστά αναντικατάστατο σε μεταγωγές υψηλής αξιοπιστίας:

- Αντίσταση στη διάβρωση από τόξο: Ο άργυρος αντέχει στις ακραίες θερμοκρασίες (3.000-20.000°C) που παράγονται κατά το σχηματισμό τόξου

- Αντι-συγκολλητικές ιδιότητες: Αποτρέπει τη σύντηξη επαφών υπό υψηλά ρεύματα εισόδου

- Αντίσταση στην οξείδωση: Το οξείδιο του αργύρου (Ag₂O) παραμένει αγώγιμο, σε αντίθεση με το οξείδιο του χαλκού

- Θερμική αγωγιμότητα: Απομακρύνει γρήγορα τη θερμότητα από τα σημεία επαφής

Η Εξέλιξη στις Επαφές Κράματος Αργύρου

Ο καθαρός άργυρος, παρά την εξαιρετική του αγωγιμότητα, στερείται της μηχανικής αντοχής και της αντίστασης στο τόξο που απαιτούνται για σύγχρονες εφαρμογές μεταγωγής. Η βιομηχανία έχει αναπτύξει εξελιγμένα συστήματα κράματος αργύρου βελτιστοποιημένα για συγκεκριμένες συνθήκες λειτουργίας:

| Τύπος Κράματος | Περιεκτικότητα σε Άργυρο | Βασικά Πρόσθετα | Κύρια Εφαρμογές | Βασικές ιδιότητες |

|---|---|---|---|---|

| AgSnO₂ | 88-95% | Οξείδιο Κασσιτέρου (5-12%) | Επαφείς, MCCB, ρελέ ισχύος | Εξαιρετική αντίσταση στη διάβρωση από τόξο, φιλικό προς το περιβάλλον, αντικατέστησε το AgCdO |

| AgNi | 85-95% | Νικέλιο (5-15%) | Ρελέ, βοηθητικοί διακόπτες, μικροί επαφείς | Υψηλή αντοχή στη φθορά, καλές αντι-συγκολλητικές ιδιότητες |

| AgW / AgWC | 50-75% | Βολφράμιο / Καρβίδιο του Βολφραμίου | Διακόπτες κυκλώματος υψηλής ισχύος | Ακραία σκληρότητα, ανώτερη απόσβεση τόξου |

| AgCu | 90-97% | Χαλκός (3-10%) | Διακόπτες χαμηλού ρεύματος, σύνδεσμοι | Οικονομικά αποδοτικό, καλή μηχανική αντοχή |

| AgSnO₂In₂O₃ | ~90% | SnO₂ + In₂O₃ (3-5%) | Ρελέ αυτοκινήτων, μεταγωγή ακριβείας | Ενισχυμένες ιδιότητες αντι-μεταφοράς υλικού |

Η μετάβαση από το οξείδιο του αργύρου-καδμίου (AgCdO) στο οξείδιο του αργύρου-κασσιτέρου (AgSnO₂) αντιπροσωπεύει μία από τις σημαντικότερες αλλαγές υλικών της βιομηχανίας. Ενώ το AgCdO προσέφερε εξαιρετική απόδοση, οι περιβαλλοντικοί κανονισμοί (RoHS, REACH) επέβαλαν τη σταδιακή κατάργησή του λόγω της τοξικότητας του καδμίου. Οι σύγχρονες επαφές AgSnO₂ τώρα ταιριάζουν ή υπερβαίνουν την απόδοση του AgCdO, ενώ παραμένουν συμβατές με το περιβάλλον.

Ο Υποστηρικτικός Ρόλος του Χαλκού

Ο χαλκός χρησιμεύει ως ο ηλεκτρικός “σκελετός” του εξοπλισμού χαμηλής τάσης, χειριζόμενος τη μετάδοση ρεύματος μέσω ράβδων ζυγών, ακροδεκτών και διαδρομών αγωγών. Με αγωγιμότητα 97% IACS και σημαντικά χαμηλότερο κόστος από τον άργυρο, ο χαλκός κυριαρχεί σε εφαρμογές υψηλού όγκου και χαμηλής αντίστασης όπου δεν πραγματοποιείται μεταγωγή.

Οι περιορισμοί του χαλκού γίνονται εμφανείς υπό συνθήκες μεταγωγής. Το οξείδιο του χαλκού (CuO) σχηματίζει ένα μονωτικό στρώμα που αυξάνει την αντίσταση επαφής με την πάροδο του χρόνου. Αυτό καθιστά τον καθαρό χαλκό ακατάλληλο για επιφάνειες επαφής, αν και παραμένει ιδανικός για σταθερά εξαρτήματα μεταφοράς ρεύματος.

Κατάταξη Ευαισθησίας στον Άργυρο: Ποιος Εξοπλισμός Είναι Πιο Ευάλωτος;

1. Επαφείς: Ο Πρωταθλητής Εντάσεως Αργύρου (Υψηλότερη Ευαισθησία)

Επίπτωση Κόστους Αργύρου: 25-55% του συνολικού κόστους υλικών

Οι επαφείς αντιπροσωπεύουν την πιο εξαρτημένη από τον άργυρο κατηγορία στον ηλεκτρολογικό εξοπλισμό χαμηλής τάσης. Αυτά τα εργαλεία των βιομηχανικών συστημάτων ελέγχου πρέπει να αντέχουν εκατομμύρια κύκλους μεταγωγής υπό απαιτητικές συνθήκες—καθιστώντας τις επαφές αργύρου απολύτως απαραίτητες.

Γιατί οι Επαφείς Καταναλώνουν Τόσο Άργυρο

Σε αντίθεση με τους διακόπτες κυκλώματος που χειρίζονται κυρίως συνθήκες σφάλματος, οι επαφείς εκτελούν συχνή μεταγωγή φορτίου με υψηλά ρεύματα εισόδου. Ένας τυπικός επαφέας εκκινητή κινητήρα βιώνει:

- Ρεύματα εισόδου εκκίνησης: 6-8× ονομαστικό ρεύμα για 0,1-0,5 δευτερόλεπτα

- Ηλεκτρική διάρκεια ζωής: 200.000 έως 2.000.000+ λειτουργίες ανάλογα με τον τύπο φορτίου

- Ενέργεια τόξου: Επαναλαμβανόμενος σχηματισμός τόξου κατά τη διάρκεια κάθε κύκλου μεταγωγής

Αυτές οι σοβαρές συνθήκες λειτουργίας απαιτούν παχιές, υψηλής ποιότητας επαφές από κράμα αργύρου. Το πάχος της επαφής καθορίζει άμεσα την ηλεκτρική διάρκεια ζωής — κάθε τόξο διαβρώνει ένα μικροσκοπικό στρώμα υλικού.

Χρήση Αργύρου ανά Μέγεθος Επαφέα

| Βαθμολογία επαφέα | Τυπική Περιεκτικότητα σε Άργυρο | Κόστος Αργύρου ως % των Υλικών | Κράμα Επαφών | Ηλεκτρική Διάρκεια Ζωής (AC-3) |

|---|---|---|---|---|

| 9-25A (NEMA 00-0) | 2-5 γραμμάρια | 25-35% | AgSnO₂ (90-95% Ag) | 2.000.000 λειτουργίες |

| 32-63A (NEMA 1-2) | 8-15 γραμμάρια | 35-40% | AgSnO₂ (88-92% Ag) | 1.000.000 ops |

| 80-150A (NEMA 3-4) | 20-40 γραμμάρια | 40-45% | AgSnO₂ (88-90% Ag) | 500.000 ops |

| 185-400A (NEMA 5-6) | 60-120 γραμμάρια | 45-55% | AgSnO₂ + ακροφύσια τόξου AgW | 200.000 λειτουργίες |

Επίπτωση Κόστους από Αύξηση Τιμής Αργύρου κατά 147%

Για έναν επαφέα 200A με 50 γραμμάρια AgSnO₂ (92% περιεκτικότητα σε άργυρο):

- Περιεκτικότητα σε άργυρο: 46 γραμμάρια καθαρού αργύρου (1,48 ουγγιές troy)

- Κόστος αργύρου στα $29/oz (Ιαν 2025): $42.92

- Κόστος αργύρου στα $72/oz (Δεκ 2025): $106.56

- Αύξηση κόστους ανά μονάδα: $63.64 (+148%)

Για έναν κατασκευαστή που παράγει 100.000 επαφείς ετησίως, αυτό αντιπροσωπεύει επιπλέον $6,36 εκατομμύρια σε κόστος υλικών — πριν από την εξέταση των αυξήσεων των τιμών του χαλκού.

Χαλκός στους Επαφείς

Ο χαλκός αντιπροσωπεύει το 15-25% του κόστους υλικών στους επαφείς:

- Ηλεκτρομαγνητικό πηνίο: Επισμαλτωμένο σύρμα χαλκού (συνήθως 0,5-2,0 mm διάμετρος)

- Τερματικά ισχύος: Ορείχαλκος ή κράμα χαλκού

- Ράβδοι μεταφοράς ρεύματος: Χαλκός ή επιχρυσωμένος χαλκός

Ενώ είναι σημαντική, η επίπτωση του κόστους του χαλκού παραμένει δευτερεύουσα σε σχέση με τον άργυρο στην οικονομία των επαφέων.

2. Ρελέ: Μικρό Μέγεθος, Υψηλή Συγκέντρωση Αργύρου (Υψηλή Ευαισθησία)

Επίπτωση Κόστους Αργύρου: 8-20% του συνολικού κόστους υλικών

Τα ρελέ χρησιμοποιούν ελάχιστο άργυρο σε απόλυτο βάρος — συχνά μόνο χιλιοστόγραμμα ανά μονάδα — αλλά η υψηλή συγκέντρωση αργύρου και οι τεράστιοι όγκοι παραγωγής τα καθιστούν σημαντικά ευαίσθητα στις διακυμάνσεις των τιμών του αργύρου.

Μοτίβα Χρήσης Αργύρου στα Ρελέ

| Τύπος ρελέ | Άργυρος ανά Μονάδα | Τυπικό Κράμα | Κόστος Αργύρου % | Βασικές εφαρμογές |

|---|---|---|---|---|

| Ρελέ Ισχύος PCB (10-16A) | 20-50 mg | AgNi10-15 (90% Ag) | 8-12% | Βιομηχανικοί έλεγχοι, HVAC |

| Αυτοκινητικό Ρελέ (30-40A) | 50-100 mg | AgSnO₂In₂O₃ (90% Ag) | 12-18% | Ηλεκτρικά συστήματα οχημάτων |

| Μαγνητικό Ρελέ Μανδάλωσης | 30-80 mg | AgSnO₂ (92% Ag) | 10-15% | Έξυπνοι μετρητές, συστήματα μπαταριών |

| Ρελέ Σήματος (<2A) | 5-15 mg | AgPd ή λεπτός Ag | 15-20% | Τηλεπικοινωνίες, εξοπλισμός δοκιμών |

Γιατί τα Αυτοκινητικά Ρελέ Επηρεάζονται Περισσότερο

Τα αυτοκινητικά ρελέ αντιμετωπίζουν ιδιαίτερα απαιτητικές συνθήκες:

- Χωρητικά φορτία: Διόρθωση συντελεστή ισχύος στον φωτισμό LED

- Επαγωγικά φορτία: Κινητήρες, σωληνοειδή, συμπιεστές

- Ακραίες θερμοκρασίες: Εύρος λειτουργίας -40°C έως +125°C

- Αντοχή σε κραδασμούς: Συνεχής μηχανική καταπόνηση

Αυτές οι απαιτήσεις απαιτούν κράματα AgSnO₂In₂O₃ υψηλής ποιότητας με πρόσθετα οξειδίου του ινδίου (3-5% In₂O₃) για την αποφυγή μεταφοράς υλικού μεταξύ των επαφών. Η προσθήκη ινδίου αυξάνει περαιτέρω το κόστος των υλικών πέρα από τις βασικές τιμές του αργύρου.

Επίδραση Ενίσχυσης Όγκου

Ενώ η περιεκτικότητα σε άργυρο κάθε ρελέ είναι μικρή, οι όγκοι παραγωγής ενισχύουν τον αντίκτυπο του κόστους:

- Ένας κατασκευαστής αυτοκινητικών ρελέ πρώτης βαθμίδας που παράγει 50 εκατομμύρια μονάδες ετησίως

- Μέσος όρος 60mg αργύρου ανά ρελέ = 3.000 kg συνολικής κατανάλωσης αργύρου

- Στα 29$/oz: 2,83 εκατομμύρια $ κόστος αργύρου

- Στα 72$/oz: 7,03 εκατομμύρια $ κόστος αργύρου

- Ετήσια αύξηση κόστους: 4,2 εκατομμύρια $

3. Διακόπτες κυκλώματος: Κυριαρχία Χαλκού με Στρατηγική Χρήση Αργύρου (Μεσαία Ευαισθησία)

Αντίκτυπος Κόστους Αργύρου: 0,5-8% του συνολικού κόστους υλικών

Οι αυτόματοι διακόπτες δίνουν προτεραιότητα στον χαλκό για την ικανότητα μεταφοράς ρεύματος, ενώ χρησιμοποιούν άργυρο στρατηγικά στις επιφάνειες επαφής. Αυτή η φιλοσοφία σχεδιασμού τους καθιστά πολύ λιγότερο ευαίσθητους στις τιμές του αργύρου από τους επαφείς.

Χρήση Αργύρου ανά Τύπο Αυτόματου Διακόπτη

| Τύπος διακόπτη | Τρέχον εύρος | Περιεκτικότητα σε Άργυρο | Υλικό επικοινωνίας | Κόστος Αργύρου % |

|---|---|---|---|---|

| Μικροαυτόματος Διακόπτης (MCB) | 6-63A | 0,1-0,5 g | AgSnO₂ ή λεπτός Ag | 0.5-2% |

| Αυτόματος Διακόπτης σε Χυτοπρεσσαριστό Κέλυφος (MCCB) | 63-630A | 2-15 g | AgW / AgWC (50-75% Ag) | 1.5-5% |

| MCCB (Υψηλό Ρεύμα) | 800-1600A | 15-40 g | AgW / AgWC | 3-8% |

| Διακόπτης κυκλώματος αέρα (ACB) | 630-6300A | 50-200 g | AgW κύριο + AgC δημιουργίας τόξου | 2-6% |

Γιατί οι Αυτόματοι Διακόπτες Χρησιμοποιούν Λιγότερο Άργυρο

Οι αυτόματοι διακόπτες διαφέρουν θεμελιωδώς από τους επαφείς στη φιλοσοφία λειτουργίας τους:

- Σπάνια λειτουργία: Σχεδιασμένοι για περιστασιακή διακοπή σφάλματος, όχι για συνεχή μεταγωγή

- Λειτουργία βραχυκυκλώματος: Βελτιστοποιημένοι για υψηλή ικανότητα διακοπής και όχι για ηλεκτρική αντοχή

- Συγκέντρωση ενέργειας τόξου: Ακραία αλλά σύντομη έκθεση σε τόξο κατά την εκκαθάριση σφάλματος

Αυτές οι συνθήκες ευνοούν τα κράματα αργύρου-βολφραμίου (AgW) και αργύρου-καρβιδίου του βολφραμίου (AgWC) με περιεκτικότητα σε άργυρο 50-75% — σημαντικά χαμηλότερη από το 88-95% άργυρο στα υλικά των επαφέων.

Κυριαρχία Χαλκού στους Αυτόματους Διακόπτες

Ο χαλκός αντιπροσωπεύει το 30-50% του κόστους υλικών MCCB:

- Κύρια διαδρομή ρεύματος: Χοντρές ράβδοι χαλκού (διατομή 5-15mm)

- Ακροδέκτες: Ορείχαλκος ή κράμα χαλκού με υψηλή δύναμη σύσφιξης

- Εύκαμπτες συνδέσεις: Χάλκινα πλεξούδες για κινητές επαφές

Για έναν MCCB 400A:

- Περιεκτικότητα σε χαλκό: ~800-1200 γραμμάρια

- Περιεκτικότητα σε άργυρο: ~8-12 γραμμάρια

- Αντίκτυπος κόστους χαλκού >> Αντίκτυπος κόστους αργύρου

4. Ασφάλειες: Επικέντρωση στον Χαλκό με Ελάχιστο Άργυρο (Χαμηλή Ευαισθησία)

Αντίκτυπος Κόστους Αργύρου: 2-8% του συνολικού κόστους υλικών

Οι ασφάλειες αντιπροσωπεύουν την κατηγορία προστατευτικών συσκευών με τη μικρότερη ευαισθησία στον άργυρο. Η αρχή λειτουργίας τους — θυσιαστική τήξη ενός τηκόμενου στοιχείου — καθιστά τον χαλκό το κυρίαρχο υλικό.

Χρήση Αργύρου στις Ασφάλειες

| Τύπος ασφάλειας | Χρήση Αργύρου | Εφαρμογή Αργύρου | Κόστος Αργύρου % |

|---|---|---|---|

| Τυπική Ασφάλεια Φυσίγγιου | Καμία έως ίχνη | Επικασσιτερωμένοι χάλκινοι ακροδέκτες | 0-1% |

| Ασφάλεια Υψηλής Ταχύτητας | 0,5-2 g | Χάλκινα ακραία καπάκια με επίστρωση αργύρου | 2-4% |

| Ασφάλεια ημιαγωγών | 1-5 g | Τήγμα από κράμα AgCu (10-30% Ag) | 5-8% |

| Ασφάλεια HRC (Υψηλής Ικανότητας Διάρρηξης) | 0.2-1 g | Επιφάνειες επαφής με επικάλυψη αργύρου | 1-3% |

Γιατί οι ασφάλειες χρησιμοποιούν ελάχιστο άργυρο

Το ίδιο το τηγμένο στοιχείο—το βασικό λειτουργικό στοιχείο—είναι σχεδόν πάντα καθαρός χαλκός ή κράμα χαλκού:

- Έλεγχος σημείου τήξης: Το σημείο τήξης του χαλκού στους 1.085°C παρέχει προβλέψιμα χαρακτηριστικά χρόνου-ρεύματος

- Οικονομική αποδοτικότητα: Το κόστος του χαλκού είναι 1/200 του αργύρου ανά γραμμάριο

- Θυσιαστική σχεδίαση: Το στοιχείο καταστρέφεται κατά τη λειτουργία, καθιστώντας τα ακριβά υλικά οικονομικά μη πρακτικά

Ο άργυρος εμφανίζεται μόνο στις επιφάνειες επαφής όπου:

- Η αντοχή στη διάβρωση είναι κρίσιμη για τη διάρκεια ζωής στο ράφι

- Η χαμηλή αντίσταση επαφής εξασφαλίζει ακριβή ανίχνευση ρεύματος

- Η αξιοπιστία σύνδεσης επηρεάζει τη συνολική απόδοση του συστήματος

Κυριαρχία χαλκού

Ο χαλκός αντιπροσωπεύει το 35-50% του κόστους υλικών της ασφάλειας:

- Τηγμένο στοιχείο: Σύρμα καθαρού χαλκού, ταινία ή διάτρητη λωρίδα

- Τερματικά καπάκια: Ορείχαλκος ή κράμα χαλκού

- Συνδέσεις ακροδεκτών: Χαλκός ή χαλκός με επικάλυψη κασσίτερου

5. Διακόπτες απομόνωσης: Βαρύς χαλκός, ελαφρύς άργυρος (Πολύ χαμηλή ευαισθησία)

Επίπτωση κόστους αργύρου: 1-5% του συνολικού κόστους υλικών

Οι διακόπτες απομόνωσης (διακόπτες αποσύνδεσης) δίνουν προτεραιότητα στην ορατή απομόνωση και την ικανότητα μεταφοράς ρεύματος έναντι της απόδοσης μεταγωγής. Αυτή η φιλοσοφία σχεδιασμού ελαχιστοποιεί τις απαιτήσεις αργύρου.

Χρήση αργύρου σε απομονωτές

| Τύπος απομονωτή | Τρέχουσα βαθμολογία | Περιεκτικότητα σε Άργυρο | Επεξεργασία επαφής | Κόστος Αργύρου % |

|---|---|---|---|---|

| Περιστροφικός απομονωτής | 16-63A | 0,5-2 g | Χαλκός με επικάλυψη αργύρου | 1-3% |

| Διακόπτης φορτίου | 63-400A | 2-8 g | Σύνθετο AgCu (5-15% Ag) | 2-5% |

| Αποσύνδεση με ασφάλεια | 30-200A | 1-4 g | Επαφές με επικάλυψη αργύρου | 1-4% |

Γιατί οι απομονωτές χρησιμοποιούν ελάχιστο άργυρο

Οι απομονωτές έχουν σχεδιαστεί για σπάνια λειτουργία υπό συνθήκες χωρίς φορτίο ή ελάχιστου φορτίου:

- Συχνότητα μεταγωγής: Συνήθως <100 λειτουργίες ανά έτος

- Διακοπή φορτίου: Συχνά απαγορεύεται ή περιορίζεται σε ελάχιστα ρεύματα

- Πίεση επαφής: Η υψηλή μηχανική δύναμη μειώνει την ανάγκη για υλικά επαφής υψηλής ποιότητας

Πολλοί απομονωτές χρησιμοποιούν επιμετάλλωση αργύρου (πάχους 5-15 μικρών) πάνω από χάλκινες επαφές αντί για συμπαγή κράματα αργύρου. Αυτό παρέχει επαρκή αντοχή στη διάβρωση και αγωγιμότητα με ελάχιστη κατανάλωση αργύρου.

Κυριαρχία χαλκού

Ο χαλκός αντιπροσωπεύει το 40-60% του κόστους υλικών του απομονωτή:

- Κύριες επαφές: Χοντρές ράβδοι ή λεπίδες χαλκού

- Ζυγοί (Busbars): Στερεά χάλκινη κατασκευή (διατομή 10-30mm)

- Ακροδέκτες: Βαρέως τύπου χάλκινοι ακροδέκτες

6. Πίνακες διανομής και πίνακες διακοπτών: Οι βασιλιάδες του χαλκού (Ελάχιστη ευαισθησία στον άργυρο)

Επίπτωση κόστους αργύρου: <1% του συνολικού κόστους υλικών

Οι πίνακες διανομής, τα κέντρα φορτίου και οι συναρμολογήσεις πινάκων διακοπτών αντιπροσωπεύουν την κατηγορία με τη μικρότερη ευαισθησία στον άργυρο. Ο άργυρος υπάρχει μόνο στις προστατευτικές συσκευές (διακόπτες, ασφάλειες) που είναι εγκατεστημένες στον πίνακα—όχι στην ίδια τη δομή του πίνακα.

Κατανομή υλικών σε εξοπλισμό διανομής

| Στοιχείο | Κύριο υλικό | Τυπικό βάρος (Πίνακας 400A) | Ποσοστό κόστους |

|---|---|---|---|

| Κύριες ζυγόγέφυρες | Χαλκός (με επικάλυψη κασσίτερου ή αργύρου) | 15-30 kg | 45-55% |

| Δευτερεύουσες ζυγόγέφυρες | Χαλκός | 5-10 κιλά | 10-15% |

| Μπάρες ουδετέρου/γείωσης | Χαλκός | 3-8 κιλά | 5-10% |

| Περίβλημα | Χάλυβας ή αλουμίνιο | 20-40 κιλά | 15-20% |

| Διακόπτες (εγκατεστημένοι) | Μικτό (περιέχει άργυρο) | 2-5 κιλά | 10-15% |

Ευαισθησία στην τιμή του χαλκού

Οι κατασκευαστές εξοπλισμού διανομής αντιμετωπίζουν ακραία ευαισθησία στις διακυμάνσεις της τιμής του χαλκού:

Παράδειγμα: Πίνακας με κλέμες σύνδεσης 400A

- Συνολική περιεκτικότητα σε χαλκό: 25 κιλά

- Κόστος χαλκού στα 8.000€/τόνο: 200€

- Κόστος χαλκού στα 11.000€/τόνο (+37,5%): 275€

- Αύξηση κόστους ανά πίνακα: 75€

Για έναν κατασκευαστή που παράγει 50.000 πίνακες ετησίως:

- Ετήσια αύξηση κόστους: 3,75 εκατομμύρια €

Αυτή η ευαισθησία στον χαλκό υπερβαίνει κατά πολύ οποιαδήποτε πίεση κόστους που σχετίζεται με τον άργυρο στον εξοπλισμό διανομής.

Περιεκτικότητα σε άργυρο (Έμμεση)

Ο άργυρος στους πίνακες διανομής υπάρχει μόνο μέσα στις εγκατεστημένες διατάξεις προστασίας:

- Οικιακός πίνακας 12 κυκλωμάτων με MCB: ~2-3 γραμμάρια συνολικά άργυρου

- Εμπορικός πίνακας 42 κυκλωμάτων: ~8-12 γραμμάρια συνολικά άργυρου

- Βιομηχανικός πίνακας με MCCB: ~30-80 γραμμάρια συνολικά άργυρου

Συνοπτικός Πίνακας Κατάταξης Ευαισθησίας

| Τύπος Εξοπλισμού | Ευαισθησία στον άργυρο | Ευαισθησία στον χαλκό | Κόστος Αργύρου % | Κόστος χαλκού | Εύρη ρεύματος που επηρεάζονται περισσότερο |

|---|---|---|---|---|---|

| Επαφείς | ★★★★★ (Ακραία) | ★★★☆☆ (Μέτρια) | 25-55% | 15-25% | 150A+ (NEMA 3-6) |

| Ρελέ | ★★★★☆ (Υψηλή) | ★★☆☆☆ (Χαμηλή) | 8-20% | 10-18% | Αυτοκινητοβιομηχανία, ρελέ ισχύος |

| Διακόπτες κυκλώματος | ★★★☆☆ (Μέτρια) | ★★★★☆ (Υψηλή) | 0.5-8% | 30-50% | 400A+ MCCB, ACB |

| Ασφάλειες | ★★☆☆☆ (Χαμηλή) | ★★★★☆ (Υψηλή) | 2-8% | 35-50% | Μόνο ασφάλειες ημιαγωγών |

| Διακόπτες απομόνωσης | ★☆☆☆☆ (Πολύ χαμηλή) | ★★★★★ (Πολύ υψηλή) | 1-5% | 40-60% | Όλες οι ονομαστικές τιμές |

| Πίνακες Διανομής | ☆☆☆☆☆ (Αμελητέα) | ★★★★★ (Ακραία) | <1% | 45-62% | Όλες οι διαμορφώσεις |

Βιομηχανικοί Παράγοντες Ζήτησης: Γιατί δεν είναι μια Προσωρινή Αύξηση

Η κατανόηση της διαρθρωτικής φύσης της ζήτησης αργύρου βοηθά να εξηγηθεί γιατί το κόστος του ηλεκτρολογικού εξοπλισμού θα παραμείνει αυξημένο:

Εγκαταστάσεις Ηλιακών Φωτοβολταϊκών

Ο άργυρος χρησιμεύει ως ο κύριος αγωγός στη μεταλλοποίηση των ηλιακών κυψελών. Κάθε ηλιακό πάνελ περιέχει 10-15 γραμμάρια αργύρου και οι παγκόσμιες εγκαταστάσεις συνεχίζουν να επιταχύνονται:

- 2024: 500 GW εγκατεστημένη ισχύς

- Προβολή 2026: 600+ GW εγκατεστημένη ισχύς

- Ζήτηση αργύρου: 230+ εκατομμύρια ουγγιές ετησίως μόνο από την ηλιακή ενέργεια

Η ζήτηση μόνο από την ηλιακή ενέργεια καταναλώνει πλέον το 20% της παγκόσμιας παραγωγής αργύρου.

Διάδοση Ηλεκτρικών Οχημάτων

Τα σύγχρονα ηλεκτρικά οχήματα περιέχουν 25-50 γραμμάρια αργύρου σε αισθητήρες, επαφείς, συστήματα διαχείρισης μπαταριών και ηλεκτρονικά ισχύος. Τα ηλεκτρικά οχήματα μπαταρίας (BEV) χρησιμοποιούν 67-79% περισσότερο άργυρο από τους κινητήρες εσωτερικής καύσης.

- 2025: 12 εκατομμύρια ηλεκτρικά οχήματα παράγονται παγκοσμίως

- Προβολή 2031: 35 εκατομμύρια ηλεκτρικά οχήματα ετησίως

- Ανάπτυξη ζήτησης αργύρου: 3,4% CAGR έως το 2031

AI και Υποδομή Κέντρων Δεδομένων

Η εκρηκτική ανάπτυξη των φόρτων εργασίας τεχνητής νοημοσύνης οδηγεί στην κατασκευή κέντρων δεδομένων με πρωτοφανείς ρυθμούς. Τα ηλεκτρικά εξαρτήματα υψηλής απόδοσης, οι επαφές ακριβείας και τα συστήματα θερμικής διαχείρισης απαιτούν όλα άργυρο.

Η κατανάλωση ηλεκτρικής ενέργειας των κέντρων δεδομένων πλησιάζει τα 1.000 TWh ετησίως έως το 2026 — αντιπροσωπεύοντας το 3-5% της παγκόσμιας ζήτησης ηλεκτρικής ενέργειας και δημιουργώντας διαρκή ζήτηση για ηλεκτρική υποδομή με έντονη χρήση αργύρου.

Στρατηγικές Επιπτώσεις για τους Αγοραστές Ηλεκτρολογικού Εξοπλισμού

Για Υπεύθυνους Προμηθειών

- Δώστε προτεραιότητα στις μακροχρόνιες σχέσεις με τους προμηθευτές: Οι κατασκευαστές με συμβόλαια αγοράς αργύρου μελλοντικής εκπλήρωσης μπορούν να προσφέρουν πιο σταθερές τιμές

- Εξετάστε την υποκατάσταση προϊόντων: Όπου είναι εφικτό, καθορίστε εξοπλισμό με χαμηλότερη περιεκτικότητα σε άργυρο (π.χ. MCCB αντί για μεγάλους επαφείς για προστασία κινητήρα)

- Αξιολογήστε το συνολικό κόστος ιδιοκτησίας: Οι επαφές αργύρου υψηλότερης ποιότητας μπορεί να δικαιολογούν υψηλότερες τιμές μέσω της εκτεταμένης διάρκειας ζωής

- Ζητήστε διαφάνεια στο κόστος των υλικών: Η κατανόηση των στοιχείων κόστους αργύρου έναντι χαλκού επιτρέπει καλύτερη διαπραγμάτευση

Για Μηχανικούς Σχεδιασμού

- Επιλέξτε επαφείς με το σωστό μέγεθος: Οι υπερμεγέθεις επαφείς σπαταλούν ακριβό άργυρο—επιλέξτε ονομαστικές τιμές με βάση τις πραγματικές απαιτήσεις φορτίου

- Εξετάστε υβριδικά συστήματα προστασίας: Συνδυάστε MCCB (με κυρίαρχο τον χαλκό) με μικρότερους επαφείς (με κυρίαρχο τον άργυρο) για βέλτιστο κόστος

- Καθορίστε τις απαιτήσεις ηλεκτρικής ζωής: Η μεγαλύτερη ηλεκτρική ζωή απαιτεί παχύτερες επαφές αργύρου—εξισορροπήστε το κόστος με τη συχνότητα αντικατάστασης

- Αξιολογήστε εναλλακτικές λύσεις στερεάς κατάστασης: Για συγκεκριμένες εφαρμογές, οι επαφείς στερεάς κατάστασης εξαλείφουν εντελώς τις επαφές αργύρου

Για Ομάδες Συντήρησης

- Εφαρμόστε προγράμματα επιθεώρησης επαφών: Η τακτική επιθεώρηση παρατείνει τη διάρκεια ζωής των επαφών αργύρου και αποτρέπει την πρόωρη αντικατάσταση

- Παρακολουθήστε την αντίσταση επαφής: Η αυξανόμενη αντίσταση υποδεικνύει φθορά—αντικαταστήστε πριν από την αστοχία

- Κατάλληλη καταστολή τόξου: Τα RC snubbers και τα varistors μειώνουν τη διάβρωση τόξου, παρατείνοντας τη διάρκεια ζωής των επαφών αργύρου

- Αποφύγετε τα υπερμεγέθη φορτία: Η λειτουργία των επαφέων πέρα από τις ονομαστικές τιμές επιταχύνει τη διάβρωση του αργύρου

Συχνές Ερωτήσεις: Άργυρος και Χαλκός στον Ηλεκτρολογικό Εξοπλισμό

Γιατί οι κατασκευαστές δεν μπορούν απλώς να χρησιμοποιήσουν επαφές χαλκού αντί για άργυρο;

Το οξείδιο του χαλκού (CuO) σχηματίζει ένα μονωτικό στρώμα στις επαφές χαλκού, αυξάνοντας την αντίσταση με την πάροδο του χρόνου. Το οξείδιο του αργύρου (Ag₂O) παραμένει αγώγιμο, διατηρώντας χαμηλή αντίσταση επαφής καθ' όλη τη διάρκεια ζωής του προϊόντος. Για εφαρμογές μεταγωγής με συχνή λειτουργία, η ανώτερη απόδοση του αργύρου δικαιολογεί το υψηλότερο κόστος του.

Πόση ποσότητα ασημιού περιέχεται πραγματικά σε έναν τυπικό επαφέα;

Ένας επαφέας AC 100A περιέχει περίπου 15-25 γραμμάρια αργύρου (0,5-0,8 ουγγιές Troy) σε μορφή κράματος AgSnO₂. Στις τρέχουσες τιμές αργύρου (~$72/ουγγιά), αυτό αντιπροσωπεύει $36-58 σε περιεκτικότητα αργύρου ανά επαφέα.

Υπάρχουν εναλλακτικές λύσεις αντί του αργύρου στις ηλεκτρικές επαφές;

Για εφαρμογές χαμηλού ρεύματος, χαμηλής τάσης, οι επιχρυσωμένες επαφές προσφέρουν εξαιρετική απόδοση, αλλά σε ακόμη υψηλότερο κόστος. Τα υλικά με βάση τον γραφίτη λειτουργούν για συγκεκριμένες εφαρμογές DC. Ωστόσο, για γενικής χρήσης μεταγωγή AC στην περιοχή 10-1000A, κανένα υλικό δεν ταιριάζει με τον συνδυασμό αγωγιμότητας, αντοχής σε τόξο και αξιοπιστίας των κραμάτων αργύρου.

Γιατί οι τιμές του αργύρου αυξήθηκαν τόσο δραματικά το 2025;

Η αύξηση πηγάζει από διαρθρωτικά ελλείμματα προσφοράς (πέντε συνεχόμενα έτη), εκρηκτική βιομηχανική ζήτηση (ηλιακή ενέργεια, ηλεκτρικά οχήματα, υποδομή AI) και μείωση της παραγωγής ορυχείων. Σε αντίθεση με τις προηγούμενες αυξήσεις τιμών που οφείλονταν σε επενδυτικές κερδοσκοπίες, η αύξηση του 2025-2026 αντανακλά πραγματικές φυσικές ελλείψεις.

Θα επανέλθουν οι τιμές του αργύρου σε χαμηλότερα επίπεδα;

Οι περισσότεροι αναλυτές προβλέπουν ότι οι τιμές του αργύρου θα παραμείνουν αυξημένες έως το 2026-2027, με προβλέψεις που κυμαίνονται από 25-75 $/ουγγιά. Η διαρθρωτική ζήτηση από την πράσινη ενεργειακή μετάβαση και την κατασκευή ηλεκτρονικών δημιουργεί ένα μακροπρόθεσμο κατώτατο όριο στις τιμές. Σημαντικές μειώσεις των τιμών θα απαιτούσαν είτε μεγάλες νέες ανακαλύψεις ορυχείων είτε τεχνολογική υποκατάσταση - κανένα από τα δύο δεν φαίνεται πιθανό βραχυπρόθεσμα.

Πώς μπορώ να επαληθεύσω την περιεκτικότητα σε ασήμι στον ηλεκτρολογικό εξοπλισμό;

Οι αξιόπιστοι κατασκευαστές παρέχουν πιστοποιήσεις υλικών και δεδομένα σύνθεσης. Η περιεκτικότητα σε ασήμι μπορεί να επαληθευτεί μέσω ανάλυσης φθορισμού ακτίνων Χ (XRF), η οποία μετρά μη καταστροφικά τη σύνθεση του κράματος. Για την επαλήθευση της προμήθειας, ζητήστε πιστοποιητικά συμμόρφωσης υλικών (CoC) από τους προμηθευτές.

Οι χρησιμοποιημένοι αυτόματοι διακόπτες και οι επαφείς διατηρούν αξία λόγω της περιεκτικότητάς τους σε ασήμι;

Ναι, η δευτερογενής αγορά για ηλεκτρικά εξαρτήματα που περιέχουν ασήμι έχει αναπτυχθεί σημαντικά. Εξειδικευμένοι ανακυκλωτές αγοράζουν χρησιμοποιημένους επαφείς, διακόπτες και ρελέ για να ανακτήσουν την περιεκτικότητα σε ασήμι. Ωστόσο, ο λειτουργικός χρησιμοποιημένος εξοπλισμός συνήθως έχει υψηλότερες τιμές από την απλή αξία των απορριμμάτων.

Συμπέρασμα: Πλοήγηση στη Νέα Πραγματικότητα των Υλικών

Η αύξηση της τιμής του αργύρου 147% του 2025 αντιπροσωπεύει κάτι περισσότερο από ένα προσωρινό σοκ κόστους—σηματοδοτεί μια θεμελιώδη αλλαγή στην οικονομία του ηλεκτρολογικού εξοπλισμού. Καθώς η βιομηχανική ζήτηση από την ηλιακή ενέργεια, τα EV και την υποδομή AI συνεχίζει να αυξάνεται, ο ρόλος του αργύρου ως κρίσιμου υλικού θα ενταθεί μόνο.

Για τους αγοραστές και τους καθοριστές ηλεκτρολογικού εξοπλισμού, η κατανόηση της ιεραρχίας ευαισθησίας αργύρου έναντι χαλκού παρέχει ουσιαστική στρατηγική διορατικότητα:

- Επαφείς αντιμετωπίζουν τη σοβαρότερη πίεση κόστους και δικαιολογούν προσεκτική στρατηγική προδιαγραφών και προμήθειας

- Ρελέ εμφανίζουν υψηλή ευαισθησία παρά τη μικρή ατομική περιεκτικότητα σε άργυρο λόγω των τεράστιων όγκων παραγωγής

- Διακόπτες κυκλωμάτων επωφελούνται από σχέδια με κυρίαρχο τον χαλκό, με τον άργυρο να παίζει υποστηρικτικό ρόλο

- Ασφάλειες και απομονωτές εμφανίζουν ελάχιστη ευαισθησία στον άργυρο, με τις διακυμάνσεις των τιμών του χαλκού να κυριαρχούν στη δομή κόστους

- Εξοπλισμός διανομής παραμένει σχεδόν εξ ολοκλήρου μονωμένος από τις τιμές του αργύρου, με τον χαλκό να αντιπροσωπεύει την κρίσιμη μεταβλητή κόστους

Οι κατασκευαστές που θα ευδοκιμήσουν σε αυτό το νέο περιβάλλον είναι αυτοί που συνδυάζουν την τεχνική καινοτομία (βελτιστοποίηση της χρήσης αργύρου χωρίς συμβιβασμούς στην απόδοση), τη στρατηγική προμήθεια υλικών (συμβόλαια μελλοντικής εκπλήρωσης και συνεργασίες με προμηθευτές) και τη διαφανή επικοινωνία με τους πελάτες σχετικά με τους παράγοντες κόστους.

Στην VIOX Electric, ανταποκριθήκαμε σε αυτές τις δυναμικές της αγοράς επενδύοντας σε προηγμένες τεχνολογίες κατασκευής επαφών που μεγιστοποιούν την αποδοτικότητα της χρήσης αργύρου, διατηρώντας παράλληλα την αξιοπιστία και την απόδοση που απαιτούν οι πελάτες μας. Η ομάδα μηχανικών μας αξιολογεί συνεχώς τα αναδυόμενα υλικά και σχέδια επαφών για να προσφέρει βέλτιστη αξία σε αυτό το δύσκολο περιβάλλον υλικών.

Σχετικοί Πόροι:

- Εσωτερικό AC Επαφέα: Εξαρτήματα & Λογική Σχεδιασμού

- Οδηγός Αντιμετώπισης Προβλημάτων Επαφέα: Βουητό & Αστοχία Πηνίου

- Λίστα Ελέγχου Συντήρησης & Επιθεώρησης Βιομηχανικού Επαφέα

- Οδηγός Σύνδεσης & Προστασίας Ράβδου MCCB

- Ονομαστικές Τιμές Αυτομάτων Διακοπτών: ICU, ICS, ICW, ICM Επεξήγηση

- Ηλεκτρική Υποβάθμιση: Θερμοκρασία, Υψόμετρο & Παράγοντες Ομαδοποίησης

Σχετικά με την VIOX Electric

Η VIOX Electric είναι ένας κορυφαίος B2B κατασκευαστής ηλεκτρολογικού εξοπλισμού χαμηλής τάσης, που ειδικεύεται σε επαφείς, διακόπτες κυκλώματος, ρελέ και εξαρτήματα διανομής. Με πάνω από 30 χρόνια εμπειρίας στον κλάδο, συνδυάζουμε την προηγμένη επιστήμη των υλικών με την κατασκευή ακριβείας για να προσφέρουμε αξιόπιστες, οικονομικά αποδοτικές λύσεις για βιομηχανικές, εμπορικές και υποδομές εφαρμογές παγκοσμίως.